The Property market works in cycles, as does the general investment market. We normally see a period of 7 to 10 years of rising property values, and as the market hits maturity and if effected by a recession, we go through durationfor a similar number of years, whereby we see a decline in property values. The Market then goes through a period of consolidation and stability reverting back to growth, the process being a cyclical one.

Although the magnitude and variants of the current economic climate are different than that as seen before, we can resonate in that the general fundamentals of any recession will remain the same,[as addressed in section 2].

If we consider the recent property boom years [2002 to 2008] we saw that there were more millionaires that were created than ever before, in fact we saw from the Times Rich List more new entries by property millionaires than that from any other sector.

In this section we will address, why people became wealthy, what allowed them to make these investment decisions, what was their winning formula, who were the losers and why did they lose, and more importantly why certain people are succeeding in the current market whilst others are hitting the wall.

What was the property boom and how was it caused?

The property boom was caused through a number of reasons such as;

- Low inflation

- Attractive interest rates

- Low unemployment

- Relaxed criteria from Lenders, people with even adverse mortgages being able to purchase properties. Some lenders offering 125% mortgage deals.

- Mass availability of credit

- High demand for housing

- Booming construction industry – meant houses were ebing sold before they were even built – off plan

- Developers getting hold of funding easily

- Real Estate Investment Trust [REITs], Self-Administered Pension Schemes [SIPPS], Genuinely Diverse Commercial Vehicle [GDCV Structures], started to purchase commercial properties as it represented excellent pension fund and taxation planning

- Television programs, refurbishments and new builds, all attracted large viewers, and as such property became in vogue.

- A DIY culture, started to emerge, people giving up their jobs and venturing in to property as a complete diversification.

- Consistently appreciating values Month on Month, meant that those even purchasing property at market value would have seen a significant growth on their investment.

So to summaries, easy funding, rising prices, followed by high demand and low supply were catalysts to the rising market. Property became fashionable, a life style statement.

Why did people become wealthy during the property boom years?

This is perhaps the most interesting section of all, almost everyone benefited from a rising housing market, but some benefited more than others, and it was those who had the foresight and the acumen of understanding the property market that yielded the highest dividend and return on investment.

Those that had purchased properties during and shortly after the last recession benefitted the most in the rise in property values. They had begun acquiring properties at low values, taking advantage of the then depressed and static market. In fact, is these very people who are busy purchasing today, making their fortunes rise even further, as they rest safe in the knowledge that the market will recover and that they will see growth over a period of time.

Their vision has not be jaded by the media, by negative spin doctors, nor has the economic downturn discouraged them in any way, as you will be able to establish from the sections below, the reasons why they continue to acquire.

Let’s consider London for example

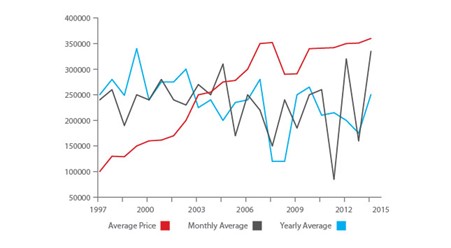

Land Registry data shows average price paid for property in London in January 1997 was £100,658 which then rose to £313,730 in January 2007, that’s an increase of approximately 312%. Put simply, a property purchased in January 1997, and providing an average rental income of £750 per month [an estimated guide over a 10 year period to factor in rental fluctuation], would have brought in gross income of £90,000. That would mean the £100,658 invested would have become as at January 2007 £403,730, put in to perspective a return of 401% based upon the initial investment.

The average house price in London as at January 2013 stands at £370,523.

Average Price

Let’s consider the North West as another Example

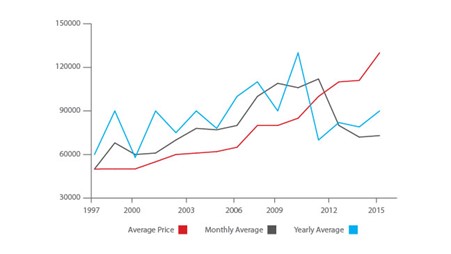

In January 1997 the average house price in the North West region was £50,782, this rose to £131,337 by January 2007, an increase of 258%. The average price in the Northwest stands at £106,435 as of January 2013. Had the property been purchased in 1997, and the price after the market correction the return would be 209%. If I was then to add the rental income that could have been received during this period [and placed an average rent of £350 [to account for the spread in rental values over the term based on a standard Tenancy basis], then the combined rental and current property value figure would be £173625, providing me with a return of 341% based on my initial investment.

Average Price - North-West

If we looked at January 1983 the average price for a property in the North West would have been £21,760, in 1993 it would have been £48,322, in 2003 it would have been £77,849 and in 2013 the value would be £106,435. This allows us to assess that there has been a gradual rise in value through each and every decade, despite recessions.